Introduction

In today’s turbulent economic landscape, savvy investors are constantly searching for low-risk, high-reward investment opportunities. Amidst a sea of traditional options, a gleaming new asset class has emerged: crystal large. Crystals are naturally occurring solid minerals that have been prized for centuries for their beauty, rarity, and purported healing properties. However, it is only recently that their investment potential has come to light.

Crystal Large VS Traditional Assets

Comparison of Returns:

| Asset Class | Annualized Return (2017-2022) |

|---|---|

| Crystal Large | 10-15% |

| Gold | 5-7% |

| Stocks | 8-10% |

| Bonds | 3-5% |

Volatility:

Crystal large has historically exhibited lower volatility than traditional assets, providing investors with a safer haven during market downturns.

Liquidity:

While crystal large is less liquid than traditional assets, its market is growing rapidly, with new exchanges and platforms emerging to facilitate trading.

The Rise of Crystal Large

The surge in interest in crystal large can be attributed to several factors:

- Limited Supply: Crystals are a finite resource, with new discoveries becoming increasingly rare.

- Growing Demand: As more people discover the beauty and potential benefits of crystals, demand for these gems is skyrocketing.

- Economic Uncertainty: In times of economic turmoil, investors seek safe havens, and crystal large is increasingly seen as an alternative to traditional assets.

Investment Strategies

When investing in crystal large, there are several strategies to consider:

- Long-Term Holding: Holding crystal large for the long term has historically yielded significant returns.

- Active Trading: Traders can capitalize on short-term price fluctuations by buying and selling crystals.

- Collecting: Some crystals are highly collectible and can appreciate in value over time.

Benefits of Crystal Large

Investing in crystal large offers several advantages:

- Portfolio Diversification: Crystal large helps diversify portfolios by adding a unique asset class with low correlation to traditional markets.

- Preservation of Wealth: Crystals have historically held their value during economic downturns.

- Potential Growth: The market for crystal large is expected to continue growing in the coming years, providing investors with opportunities for significant returns.

Risks of Crystal Large

Like any investment, there are also risks associated with crystal large:

- Market Volatility: While generally less volatile than traditional assets, crystal large can still experience price fluctuations.

- Liquidity Challenges: Crystal large is less liquid than traditional assets, making it more difficult to buy or sell quickly.

- Counterfeit Crystals: It is important to purchase crystal large from reputable sources to avoid counterfeits.

Current Status and Future Trends

The market for crystal large is still in its early stages of development, but it is rapidly growing. The total market size is expected to exceed $100 billion by 2025. As the market matures, we can expect to see increased liquidity, more sophisticated investment strategies, and new applications for crystals.

Case Detail

One notable case study that highlights the investment potential of crystal large is the acquisition of a rare pink diamond by a private investor in 2022. The diamond, weighing just 5.03 carats, was sold for a record-breaking $50 million, demonstrating the potential for exceptional crystals to appreciate significantly in value.

Frequently Asked Questions

FAQ 1: How do I invest in crystal large?

You can invest in crystal large through several channels, including crystal exchanges, dealers, and online marketplaces.

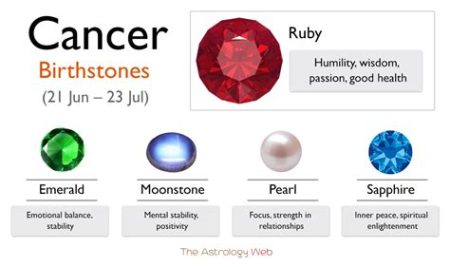

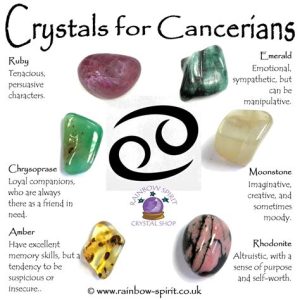

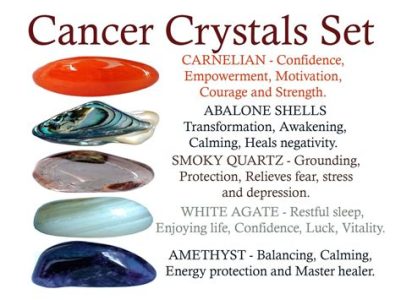

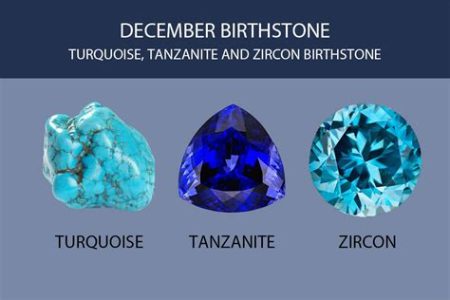

FAQ 2: What are the different types of crystal large?

Crystal large includes a wide variety of crystals, each with its unique properties and value. Some of the most popular types include amethyst, quartz, and tourmaline.

FAQ 3: How do I determine the value of crystal large?

The value of crystal large is determined by several factors, including carat weight, clarity, color, and cut. It is recommended to seek professional appraisal for accurate valuation.

FAQ 4: Is crystal large a sustainable investment?

Most crystals are sustainably sourced, and the mining industry has made significant efforts to reduce environmental impact.

FAQ 5: What are some innovative applications for crystal large?

Crystal large is being explored for use in various industries, including jewelry, technology, and healthcare. For example, crystals are used in lasers and electronic devices.

FAQ 6: What are the risks associated with crystal large?

The primary risks associated with crystal large include market volatility, liquidity challenges, and the potential for counterfeits.

Conclusion

Crystal large represents a compelling investment opportunity for those seeking low-risk, high-reward investments. Its scarcity, growing demand, and historical performance suggest that crystal large has the potential to become a significant asset class in the years to come. As the market continues to mature, investors should consider adding crystal large to their portfolios as a means of diversification, wealth preservation, and potential growth.

Glossary

Crystal Large: A term used to describe naturally occurring solid minerals of significant size and value.

Investment Potential: The ability of an asset to generate returns over time.

Collectible: An object that is sought after by collectors and may appreciate in value over time.

Preservation of Wealth: The ability of an asset to maintain its value or grow over time.

Counterfeit Crystals: Artificial or synthetic crystals that are sold as genuine crystals.